According to Gartner, global IT spending is set to be $3.9 trillion in 2020 and over $4 trillion by 2021. This creates huge opportunities for tech marketers, but knowing how to reach, engage and convert IT leads is key.

In a time where global health issues are impacting buying decisions, it’s more important than ever to get to know your audience – understanding how they think will help you run effective campaigns that convert. But the B2B technology buying cycle is long and complex, and is rarely straight-forward. Therefore, delighting customers requires the right kind of content with multiple touchpoints. For tech companies, that means staying one step ahead at all times and using IT intent data to shape strategy.

For our latest survey (in partnership with Insights for Professionals), we conducted research within our community of IT buyers to gain a greater understanding about what makes potential prospects tick – and how to harness that.

Using bespoke analytics to track their content consumption, we are able to deep dive into factors surrounding how IT professionals buy, how decisions are made and how content can be leveraged to achieve better sales results.

The aim of this study is to enlighten demand generation marketers and tech vendors on buyer behaviour.

Reading time: 10 minutes

Survey sample:

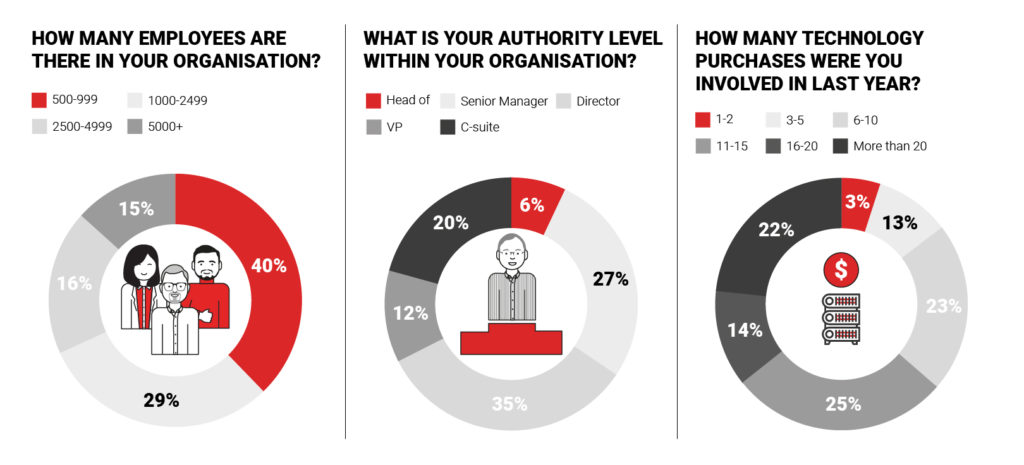

We surveyed 250 senior leaders working in IT located across the USA (200) and the UK (50). All survey participants play some part, large or small, in B2B technology purchasing decisions in their company.

In the sample set, there was an even mix of large enterprises, ranging from 500 employees to 5000+. The largest group (40%) of respondents have 500-999 employees in their organisation. Most respondents are key decision makers in the IT buying process, with a mix of department heads, senior managers, directors, vice presidents and C-suite stakeholders. The two largest groups are company directors (35%) and senior managers (27%). All decision makers in this survey have been involved in at least one technology purchase in the last year. Over 80% of these buyers are highly experienced in purchasing, investing in 6 or more projects across the year.

How IT buyers plan their budget

The main trend that we have seen in recent years is a rise in IT spending across all sectors and markets. Despite the negative impact on businesses across the globe due to Covid-19, our survey shows that IT spend is increasing year-on-year.

Reliance on technology to solve challenges and nurture growth has increased across all industries. But when and how do your customers plan their budget? And how flexible are their allocated budgets?

When do buyers plan?

Knowing when IT buyers plan their budgets is key as this allows tech marketers to create multiple touchpoints to connect with prospects along the funnel.

The sales cycle isn’t straightforward in B2B technology, and it may take months or even years to convert a lead.

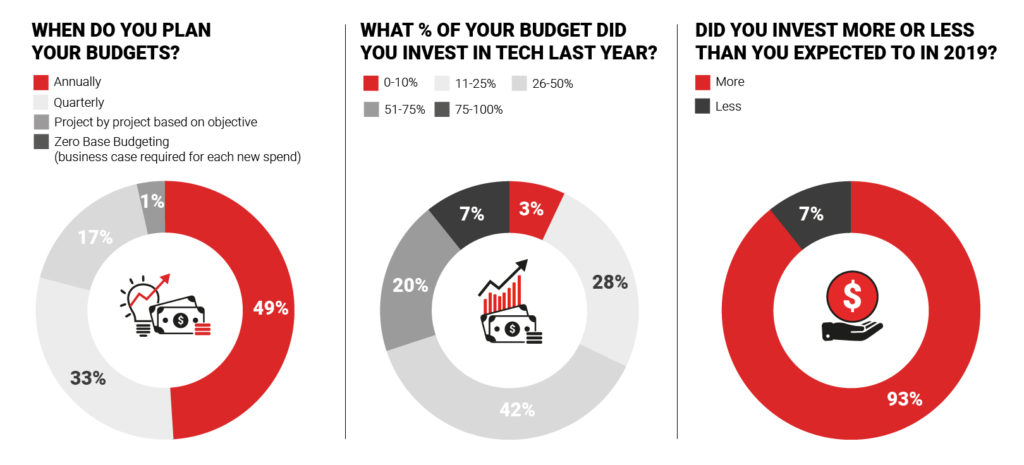

According to our survey, half of the respondents plan their IT budgets annually, while a third do it quarterly. Then a relatively small percentage do it on a project-by-project basis. Only 1% of businesses have zero base budgeting. While forward planning is important, the mixed response suggests a certain level of flexibility.

With a third of the audience making quarterly budgeting decisions, and 17% making decisions based on their objectives, it is possible to accelerate your solution up the agenda and into the decision-making process within a year using effective demand generation methods.

Do buyers go over budget?

IT and new technology investments aren’t always easy to budget for as many companies look at purchases on a project-by-project basis. As a result, budgets often go over.

Of the 250 IT buyers we asked, an astounding 93% said that they invested more than expected last year. Not only does this affirm the increased buying potential in technology, but it shows that budgets aren’t always fixed which means many prospects can still be turned into leads.

How much are buyers spending?

Our data reveals that 69% of organisations invested more than a quarter of their total business budget on IT last year.

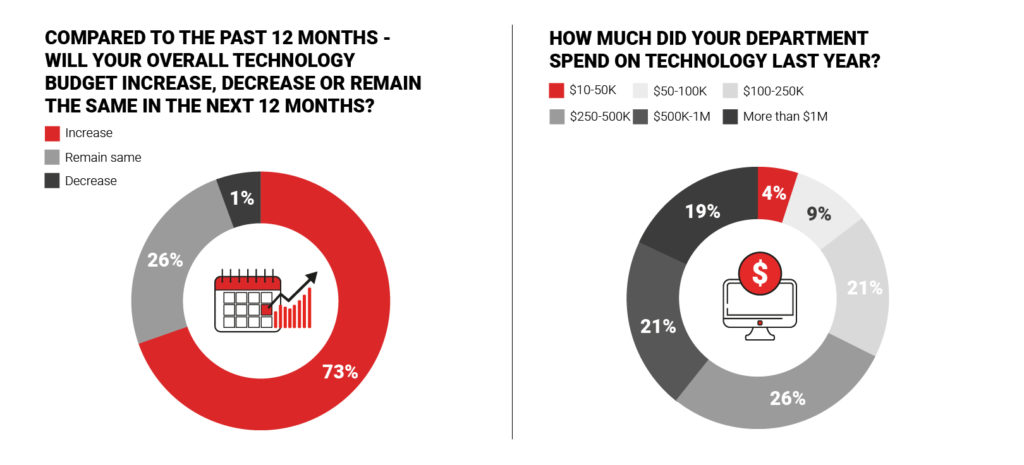

Almost 90% spent over $100,000 on technology in 2019, with 21% spending up to $250,000, 26% spending up to $500,000, 21% spending up to a million, and 19% spending over a million on projects.

Do they plan on spending more?

A third of the respondents expected to spend $500,000+ on technology last year, and our survey shows that 99% are likely to spend the same or more in the next 12 months.

A look at the decision makers

When marketing to IT leads, it’s important to consider different stakeholders. In a lot of cases, there are multiple decision makers involved and they often have conflicting goals and requirements. The perfect tech marketer needs to answer of all of their needs while helping to solve core business challenges.

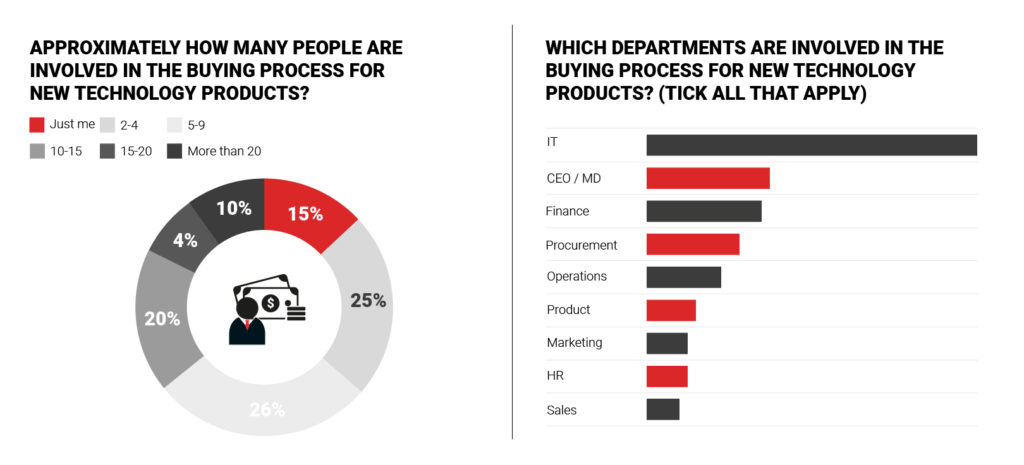

How many people are involved?

Over a third of companies have ten or more people involved in purchases. With so many different stakeholders in one purchase, it is vital to think carefully about which members of the decision-making unit to include in your lead gen targeting.

By being too strict on targeting factors like job title you could be limiting your ability to introduce your brand to your target customers. You need to make content for each member of the DMU, then target IT leads across multiple channels to make sure you are reaching all of those involved.

Who is involved?

The departments involved in IT buying will vary depending on the solution and the impact of deploying that solution. According to our survey, IT, Senior Leadership and Finance are most heavily involved. But other departments that have a stake include Procurement, Operations, Product, Marketing, HR and Sales. The inclusivity of different departments requires a customised approach for different product lines. This can be done by making sure that you have content streams for the end user of the product (utility content), the financial controller of the project (business cases = total costs of ownership vs. ROI) and executives (top line benefits for the board).

The inclusivity of different departments requires a customised approach for different product lines. This can be done by making sure that you have content streams for the end user of the product (utility content), the financial controller of the project (business cases = total costs of ownership vs. ROI) and executives (top line benefits for the board).

How IT buyers do their research

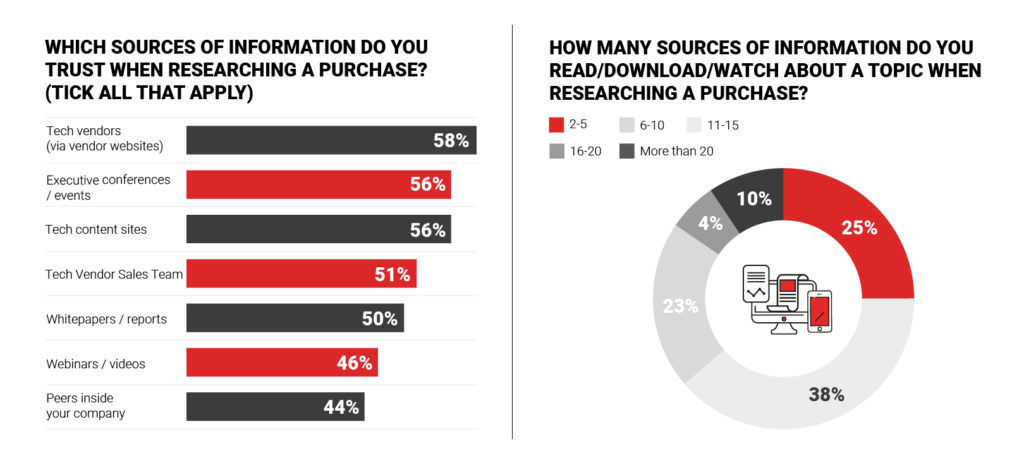

The research phase is a critical step in the buying process – this is when demand generation marketers will have opportunities to connect with their intended audience. When it comes to trusted sources of information, buyers tend to use multiple sources to help them come to an educated decision.

What content do they trust?

Our survey results show that the top places to find information are vendor websites, conferences/events and specialist content sites.

With travel being limited by current global health issues, prospects may be turning to online sources such as IFP for knowledge, guides, whitepapers and reports. Our resource hub is used by senior buyers and can be a great platform to educate, share important knowledge and generate interest in products.

How much research do they do?

In terms of the amount of research buyers do, it varies and depends very much on other factors such as their own experience and knowledge sources within their own organisation. But what’s clear is that not a single person in our survey would trust just one piece of content before a purchase.

A third of respondents research more than 10 pieces of content before committing to a decision about what to buy.

For marketers, a multi-channel approach to content amplification is needed to maximise the amount of reach you get to these important IT decision makers during the research phase. The more times you can help a prospect find your content and provide them with value, the likelier you are to be considered when it comes to buying.

For marketers, a multi-channel approach to content amplification is needed to maximise the amount of reach you get to these important IT decision makers during the research phase. The more times you can help a prospect find your content and provide them with value, the likelier you are to be considered when it comes to buying.

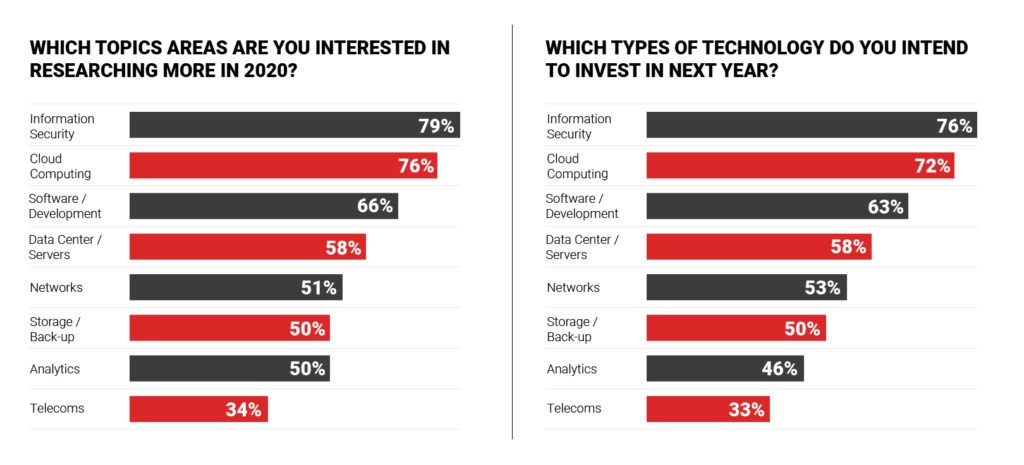

The buying trends you need to know

Of the 250 buyers we surveyed, a quarter said they are looking into cybersecurity in 2020, with another quarter interested in cloud, and a similar number interested in new software. Going into next year, the trends continue to be the same. For 2021, a quarter of respondents will be looking at cybersecurity, and the same amount of people will be looking at cloud and software.

Length of the sales cycle

Length of the sales cycle

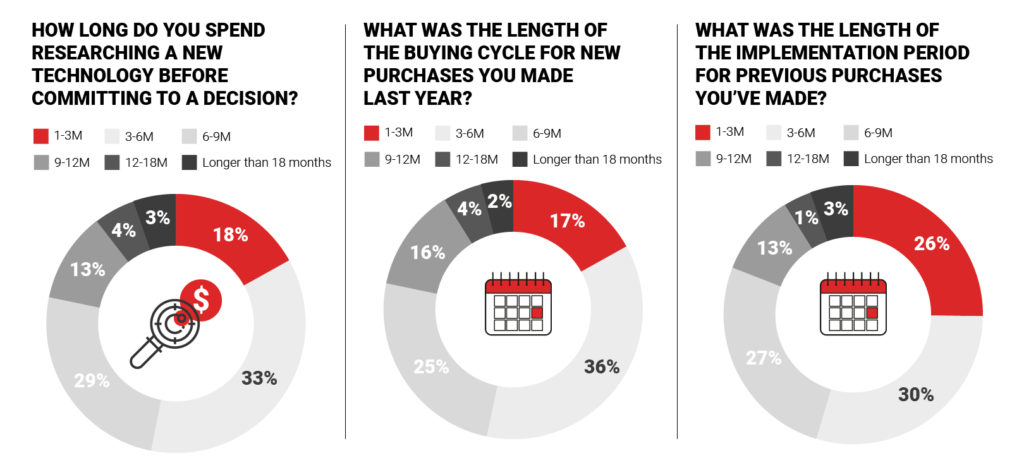

Tech buying timelines can be complex and there are three distinct phases of the process to consider: research, purchasing and implementation. While these phases can take time, our data shows promising numbers with over 90% ready to complete each stage within a year.

In total, the timeline from early content to overseeing deployment can be somewhere between 9 months and three years, with some buyers completing the process much faster.

Research stage

93% of IT leads are ready to finish their research within 12 months. This gives a window of opportunity for content and outreach.

Purchasing

94% of buyers are ready to complete the buying process within 12 months. Throughout the cycle, it’s important for tech marketers to remain in touch with their leads, nurturing them through the funnel.

Implementation stage

96% of buyers are able to complete deployment of new technology within a year too. During this phase, it’s vital for tech vendors to assist with issues such as change management to ensure that everything runs smoothly and is adopted in the right way by teams.

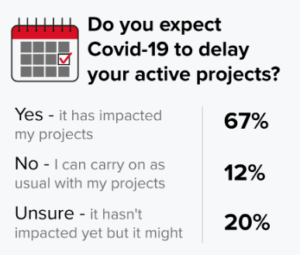

Coronavirus impact on projects

The impact of Covid-19 has resulted in delays for 67% of respondents in our survey. This highlights the importance of continued communication from vendors in order to maintain relationships during such uncertain times.

Timelines may become much longer and marketers will need to factor this into their campaigns.

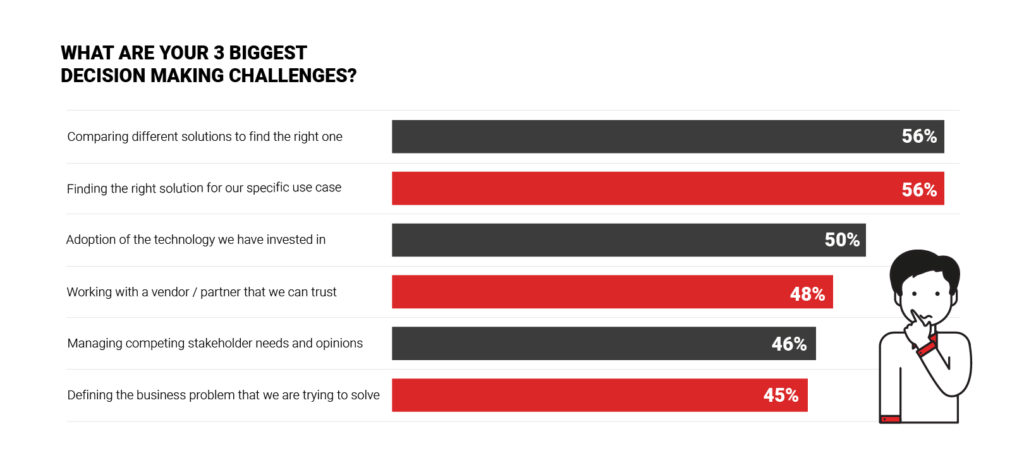

Challenges faced by buyers

There are a multitude of issues that could make the buyer’s job difficult when it comes to deciding on a purchase. This is especially the case when there are multiple stakeholders involved with conflicting objectives. On top of that, there are other vendors to consider, plus the confusion of knowing which solution is the right one for their specific needs.

B2B tech marketers should consider these challenges, then see what content they could produce to champion your brand within the decision-making process. How can you make it easier to compare your solution with the competition? What about dealing with adoption and on-boarding challenges when rolling out? If you can help the IT buyer with these hurdles now, you can turn your brand into a trustworthy option when they are ready to buy in the future.

B2B tech marketers should consider these challenges, then see what content they could produce to champion your brand within the decision-making process. How can you make it easier to compare your solution with the competition? What about dealing with adoption and on-boarding challenges when rolling out? If you can help the IT buyer with these hurdles now, you can turn your brand into a trustworthy option when they are ready to buy in the future.

The final decision…

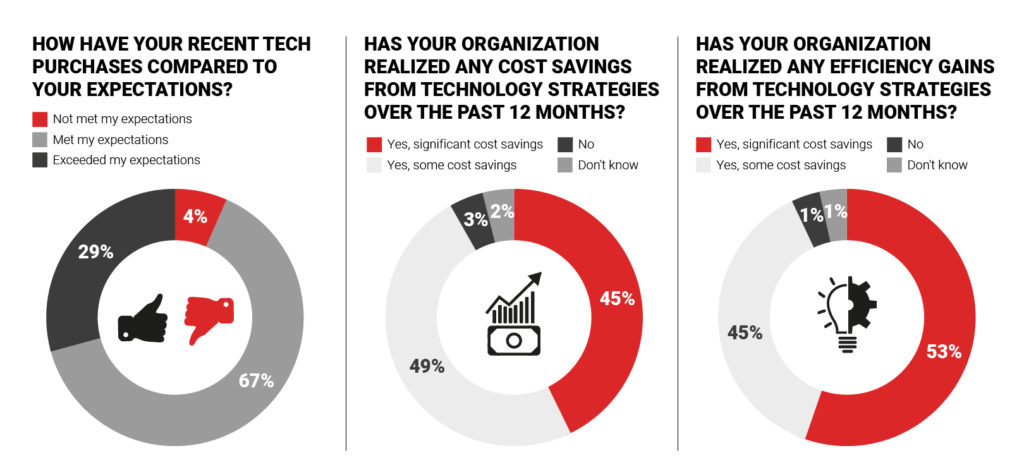

As well as asking how B2B tech buyers go about their decision-making process, our survey also analyses real life buyer outcomes. The results are resoundingly positive, with many purchases being successful.

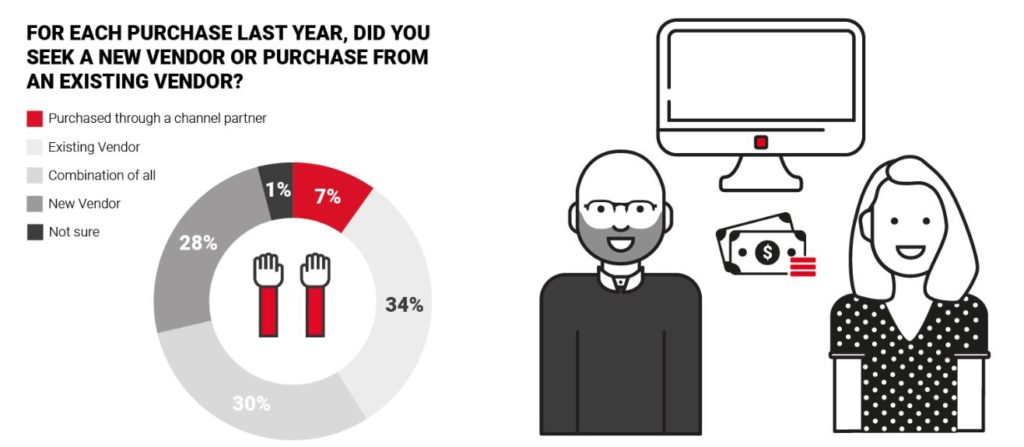

Customer loyalty

With over a third of people choosing an existing vendor for new technology purchases, it’s evident that there’s a huge opportunity for repeat sales. Strategies such as ABM (Account Based Marketing) can help you retarget high-value, existing accounts.

At the same time, buyer behaviour also shows similarly large numbers choosing new vendors or using a mix of both. This highlights great opportunities with new prospects and the scope for multiple vendors in the vast tech space.

Customer satisfaction

Only 4% of people were unhappy with their purchases. That’s an impressive 96% of satisfied buyers, with almost a third stating that products exceeded their expectations. That’s an extremely high success rate in the tech buying world. In addition to a large percentage of happy customers, many have also benefited from cost savings after implementation. A huge 95% of projects saved the enterprise or department money, indicating the value of technology to businesses.

In terms of efficiency, 98% reported efficiency gains for their company. This indicates the transformative power of embracing the digital age and adopting improvements such as cloud, process automation and other disruptive technology.

These IT insights on buyers show encouraging results from an aftersales point of view, allowing tech marketers to build long-term customer relationships for repeat business in the future. Through great customer care, vendors can leverage positive reviews, word-of-mouth marketing and recommendations to reach more prospects.

And as our research on IT buyer behaviour shows, content is key to the research stage so demand and lead gen specialists should use case studies as a part of their content strategy to target IT department heads and decision makers.

About IFP

Insight For Professionals from Inbox Insight is an online content platform that provides high quality, credible and relevant resources for senior IT professionals. By sourcing the best content from suppliers, brands and industry experts, as well as undertaking first-party market research, IFP provides IT leaders the ability to download multiple reports and whitepapers for their industry in one place.