What do our first party research insights reveal about the state of the B2B marketing strategy on both sides of the Atlantic?

While multichannel marketing is no new phenomenon, the art of building scalable, effective and cost-efficient multichannel strategies can differ enormously from business to business – and country!

Our first-party research conducted among senior B2B marketing professionals in our Insights for Professionals (IFP) Community reveals significant nuances as well as prominent similarities between current US and UK B2B multichannel strategies.

How can our unique insights guide your marketing efforts when it comes to channel adoption, investment and reporting? We take a deep dive to make sense of the latest and most essential channel research…

Reading time: 6minutes

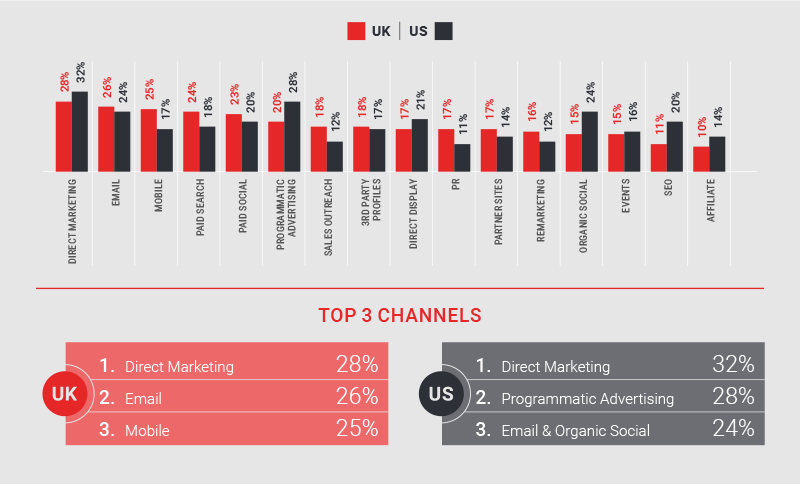

What marketing channels are most critical to your strategy?

Side-by-side analysis reveals the US (32%) and UK (28%) both perceive Direct Marketing as a critical channel to their strategy. This indicates direct response initiatives are clearly high on the agenda for B2B marketers in 2022, proving that this traditional approach is still considered in today’s digitalized world. It also suggests that engagement and reach outweigh brand awareness in this instance, given that Paid Search (18% US, 24% UK) and Paid Social (20% US, 23% UK) are both further down the ranks.

The adoption of Programmatic Advertising appears to have garnered greater significance in the US than the UK, with 28% of US survey recipients citing it as the second most vital channel compared to just a fifth in the UK.

This indicates the facility to drive data-driven messaging and relevant pieces of content to tightly defined audiences across the buyer’s journey is being leveraged more in today’s US multichannel marketing than in the UK, who are lagging behind.

Meanwhile, Organic Social features more prominently in the US (24%) than in the UK (15%), where Paid Social is favored (23%). When you consider the low reach ratios associated with delivering cut-through on the right people’s feeds – it’s surprising to see Organic Social feature in the US’s top most critical digital channels.

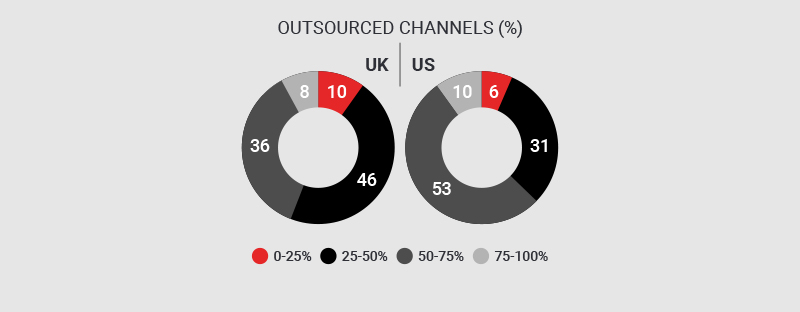

Channel outsourcing: What percentage of channels are outsourced?

Almost two-thirds (63%) of US marketers outsource between 50-100% of their channels, while just 44% of UK marketers do the same. The majority (56%) of UK marketers instead tend to outsource up to 50%, rather than beyond the halfway mark like those in the US.

This is likely to be down to the US having bigger budgets, therefore requiring the use of agencies to help manage the amount of budget and maximize its potential. This doesn’t mean in-house expertise is non-existent in the US, but that it’s more of a balancing act when it comes to prioritizing which marketing channels stay in-house vs outsourced.

Outsourcing to specialists can be costly, however, the return can be even greater thanks to their expert knowledge and optimization skills as channel specialists. Utilizing their skills should never be disregarded when it comes to achieving successful and all-rounded multichannel campaigns.

It is important, however, to ensure channel alignment doesn’t get lost when outsourcing. Creating a unified experience in multichannel campaigns should always remain at the forefront of planning and therefore regular communication, clear objective and KPI setting, and analysis of reports are highly recommended to keep all marketing channels working towards the same overarching multichannel strategy.

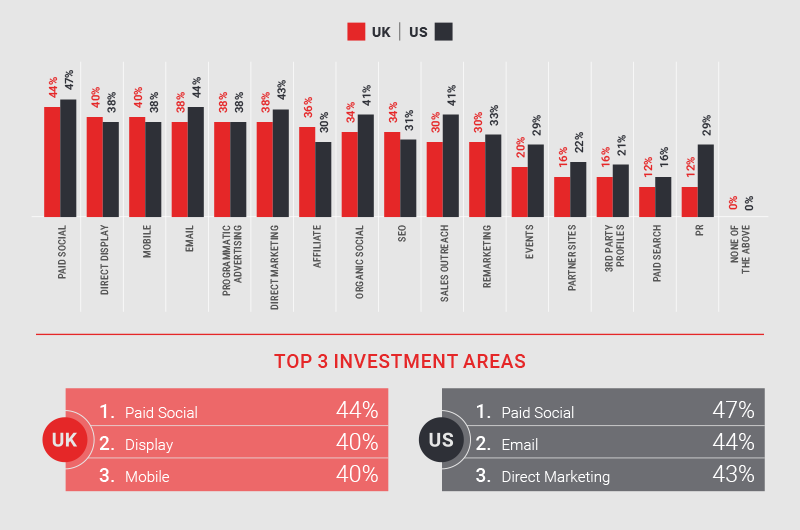

Which channels are B2B marketers intending to invest more in?

Paid Social is the clear winner when it comes to investment intentions for 2022, indicating a focus on building brand awareness and performance media to expand audience reach, cultivate leads and build brand exposure with both UK and US audiences.

The most obvious variations in investment occur with PR (US 29% vs UK 12%) and Sales Outreach (US 41% vs UK 30%). This is interesting, given that PR in the US tends to be far more expensive than in the UK. However, this is due to the sheer size of the market and the reach it has the ability to achieve, therefore making it a favorable channel in the US.

UK marketers plan to invest in Direct Display and Mobile, while those in the US look to invest more in Email and Direct Marketing. This indicates a strong emphasis on communication and reach in the US, and tying up the multichannel experience across different devices and platforms for the UK.

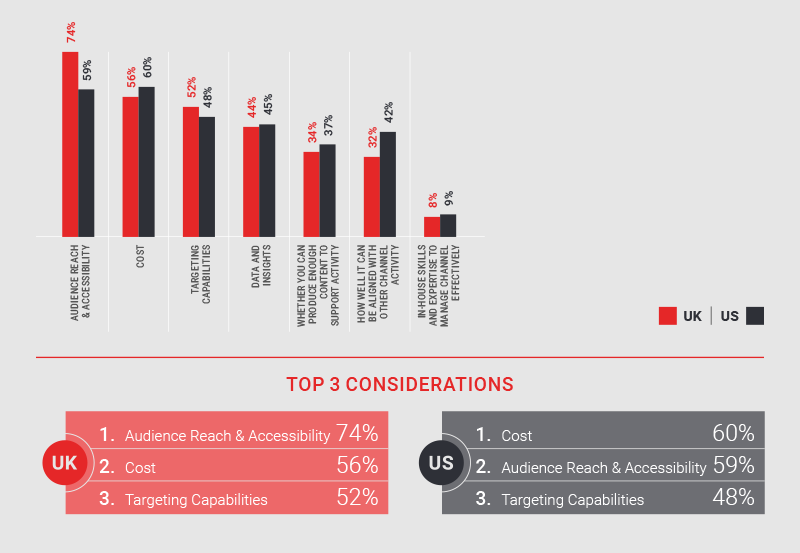

What are the key consideration points governing channel selection?

Audience Reach and Accessibility is considered the top consideration point for our UK panel respondents (74%) when deciding which channel to utilize, yet the US place it in second place (58.67%) closely behind Cost (60%). However, Cost does rank second for the UK (56%) but by almost a fifth less of the panel than their number one spot.

This indicates a predominant focus on selecting channels that have the ability to not only reach target audiences, but which have the necessary accessibility in place to do so – something which might seem standard but is all too often not the case due to the complex nature of audience data and targeting capabilities. It also emphasizes the need for the cost of such channels to be reasonable and reflective of the ROI they can deliver, especially as ‘budget spread too thin across channels’ is the top multichannel management pain point for both the US (42%) and UK (32%) marketers.

The US place greater emphasis on ‘how well a channel can be aligned with other channel activity’ (42%) while just under a third (32%) of UK marketers agree. This suggests US marketers are more acutely aware of the need to align all channels to an overarching and holistic multichannel marketing strategy in order to be successful.

This awareness could explain why just 16% of US senior marketers perceive ‘aligning channel objectives to overarching multichannel marketing strategy’ as a key challenge, as a holistic strategy will set out how to achieve this for all key stakeholders.

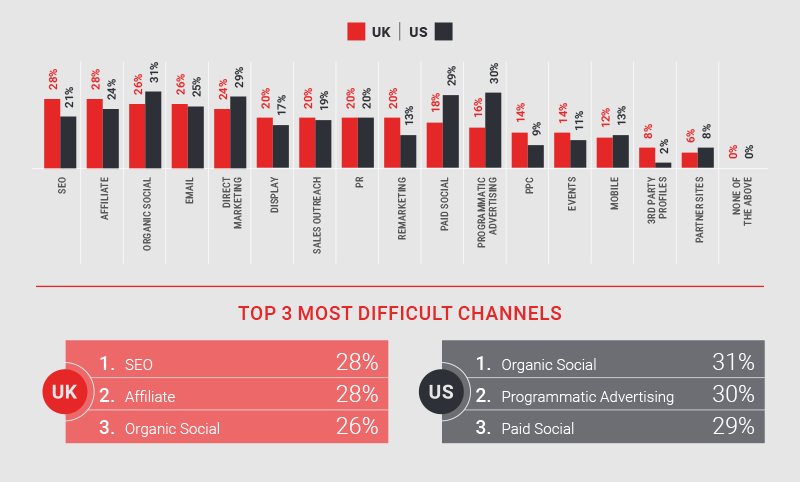

Which channels are the most difficult to manage?

US marketers find both Paid Social (28.67%) and Organic Social (26%) difficult to manage, while the UK appears to have a better grasp of Paid Social with only 18% citing this as a challenging channel.

Search Engine Optimization (SEO) appears in top place as voted by over a quarter of UK marketers (28%). However, just over a fifth (21.33%) in the US agree, suggesting that of the two countries, they have greater competencies when it comes to this specialist field.

30% of US marketers cite Programmatic Advertising as their most difficult channel to manage compared to almost half, just 16%, in the UK. This could be down to greater competition within digital advertising space in the US, causing difficulties when it comes to bidding. Other possible challenges marketers face include controlling ad placements, niche audiences, constraints around good quality data and concerns around supply-chain transparency.

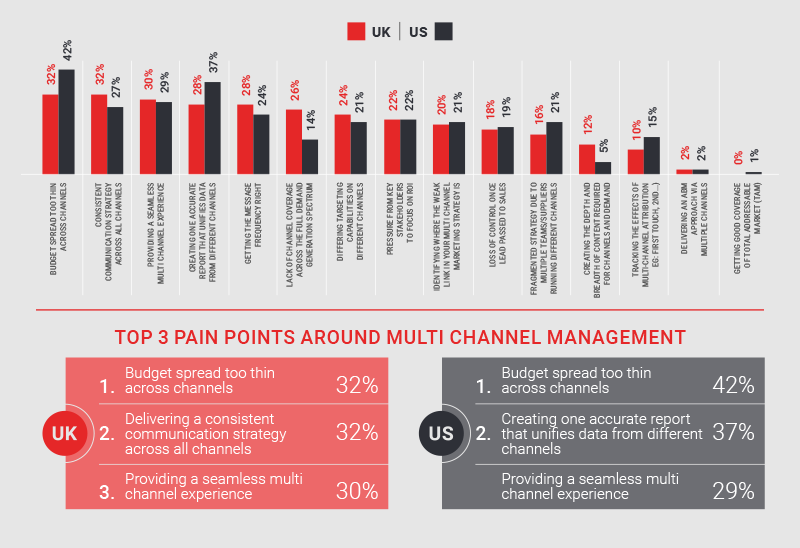

What are the biggest pain points around multichannel management?

Over two-fifths (42%) of US marketers cite ‘budget spread too thinly’ as their most prominent challenge when it comes to multi-channel management. While less than a third of UK respondents (32%) agree, it still comes out top on their list of pain points which suggests it is a significant issue felt across multichannel marketers in both the UK and US.

Likewise, ‘providing a seamless multichannel experience’ appears 3rd on the list for both countries. This indicates the significance of creating a seamless channel experience in the multichannel strategy and how both parties are still struggling to achieve it.

‘Lack of channel coverage across the full demand generation spectrum’ is a considerable obstacle for over a quarter (26%) of UK marketers compared to just 14% of US. This might suggest that US marketers are able to tap into more and varied channels spanning their customer base’s life cycle. Perhaps the UK need to work on how they can vary the channels they adopt to be more all-encompassing.

The main difference between our UK and US panel respondents around multichannel management appears to be around reporting and content strategy. The US place concerns over creating one accurate, unified report as their second biggest pain point (37.33%) while it appears as number 4 for the UK (28%). Instead, ensuring a coherent communication strategy is near the top.

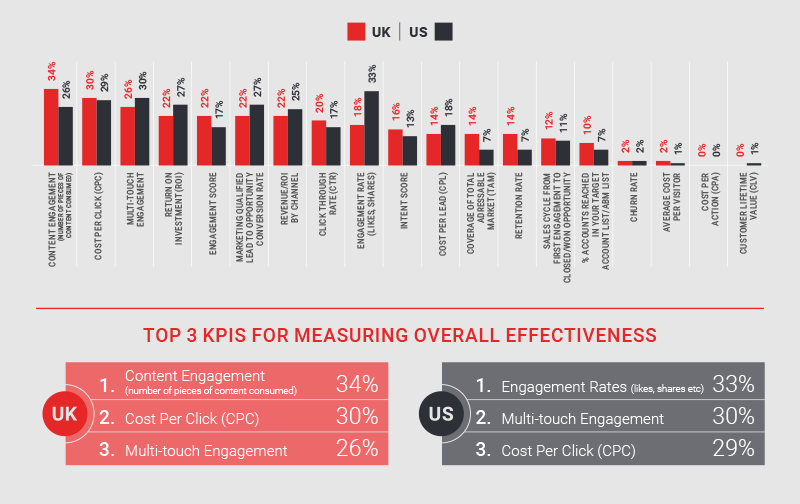

Which KPIs are used to measure overall effectiveness?

Almost a third of US marketers (32.67%) consider Engagement Rate (likes and shares) as the overarching KPI to measure overall multichannel strategy effectiveness, while less than a fifth of UK respondents (18%) agree. Instead, over a third cite Content Engagement (34%) as their top KPI compared to just over a quarter (26%) of US respondents.

So, is it better to measure Engagement Rate (US) vs. Content Engagement (UK)? Likes and shares vs. the amount of content actually consumed? There is clearly a divide in approach depending on what side of the Atlantic you sit.

Clear alignment does, however, exist between both regions when it comes to Cost per Click (CPC) and Multi-touch Engagement – both appearing in 2nd and 3rd places. It is good to see some crossover in the KPIs used in the UK and US as it allows for comparisons to be easily made, especially when it comes to reporting, and also provides reassurance that there is agreement on some of the most effective measurement tactics.

Now you know the key differences between US and UK multichannel marketing strategies…

How well does your multichannel approach tie into our first-party research findings? Have our unique insights given you food for thought when it comes to utilizing additional channels, knowing which to invest the most resource, or the channels most difficult to manage – which therefore could be worth outsourcing?

Achieving an effective multichannel marketing strategy which promotes a seamless, unified and well-aligned channel experience is never straight forward. Our findings reflect this only too well.